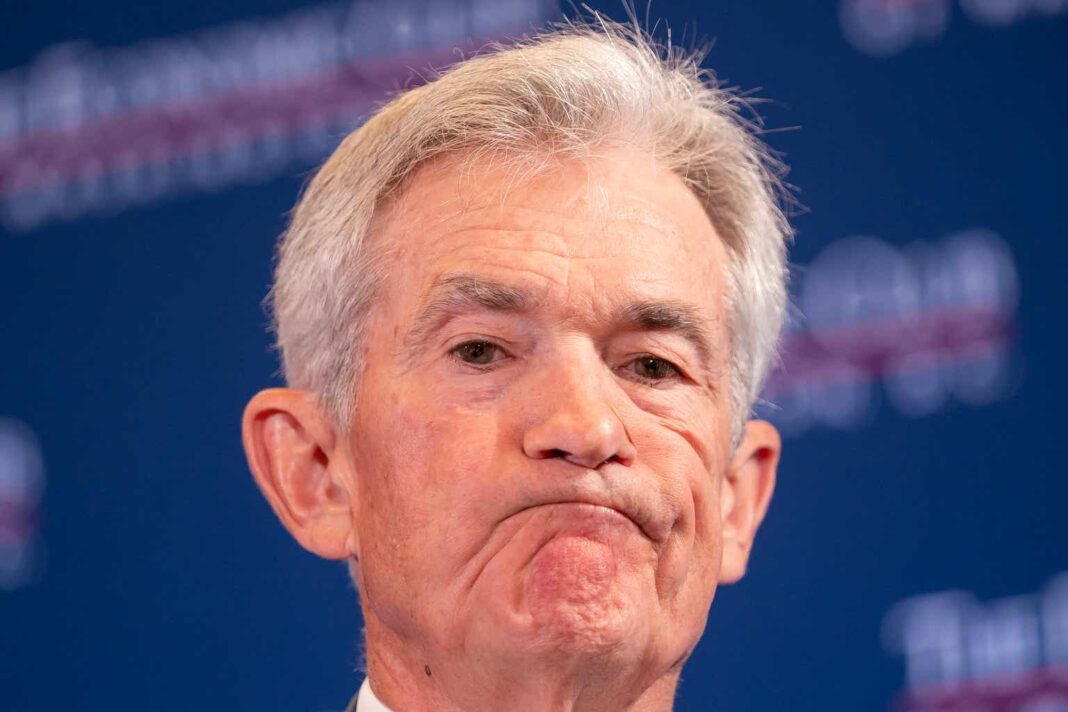

Fed Signals Likely Rate Cuts In September: Buy These 3 High-Yield Blue-Chip Stocks Today

Introduction

The Federal Reserve recently hinted at possible interest rate cuts in September to stimulate the economy. This news has sparked interest among investors looking for high-yield opportunities in the stock market. Blue-chip stocks are known for their stable performance and consistent dividends, making them an attractive option for income-seeking investors. In this article, we will discuss three high-yield blue-chip stocks that are worth considering in light of the potential rate cuts.

1. Company A

Company A is a well-established blue-chip stock in the technology sector. It has a strong track record of revenue growth and profitability, making it a reliable choice for investors. The stock also offers a high dividend yield, providing investors with a steady stream of income. With the potential rate cuts on the horizon, Company A is a promising investment opportunity for income-seeking investors.

Key Points:

- Technology sector blue-chip stock

- Strong revenue growth and profitability

- High dividend yield

2. Company B

Company B is a leading blue-chip stock in the consumer goods sector. It has a diversified product portfolio and a strong brand presence in the market. The stock has a history of consistent dividends and is known for its stability. With the potential rate cuts expected in September, Company B is a solid choice for investors looking for high-yield opportunities in the stock market.

Key Points:

- Consumer goods sector blue-chip stock

- Diversified product portfolio

- Strong brand presence

3. Company C

Company C is a reliable blue-chip stock in the financial sector. It has a strong balance sheet and a history of delivering solid returns to shareholders. The stock also offers a competitive dividend yield, making it an attractive option for income-seeking investors. With the potential rate cuts on the horizon, Company C is a wise choice for investors looking to capitalize on high-yield opportunities in the stock market.

Key Points:

- Financial sector blue-chip stock

- Strong balance sheet

- Competitive dividend yield

Conclusion

In conclusion, the Federal Reserve’s signals of likely rate cuts in September have created an opportunity for investors to capitalize on high-yield blue-chip stocks. Companies A, B, and C offer attractive dividend yields and strong fundamentals, making them worth considering for income-seeking investors. As always, it is important to conduct thorough research and consult with a financial advisor before making any investment decisions.

FAQs

1. What are blue-chip stocks?

Blue-chip stocks are large, well-established companies with a history of stable performance and reliable dividends. They are considered to be safe investments due to their strong fundamentals and market presence.

2. Why are high-yield stocks attractive to investors?

High-yield stocks offer investors the opportunity to earn a significant income through dividend payments. This can provide a valuable source of passive income and help offset market volatility.

3. How can investors benefit from potential rate cuts by the Federal Reserve?

Potential rate cuts by the Federal Reserve can lead to lower borrowing costs for companies, which can boost their profitability and stock prices. Investors can benefit from this by investing in high-yield stocks that are expected to perform well in a lower interest rate environment.