After Beefing Up IRS Tip Enforcement, Kamala Now Claims Trump’s “No Tax on Tips” Agenda As Her Own

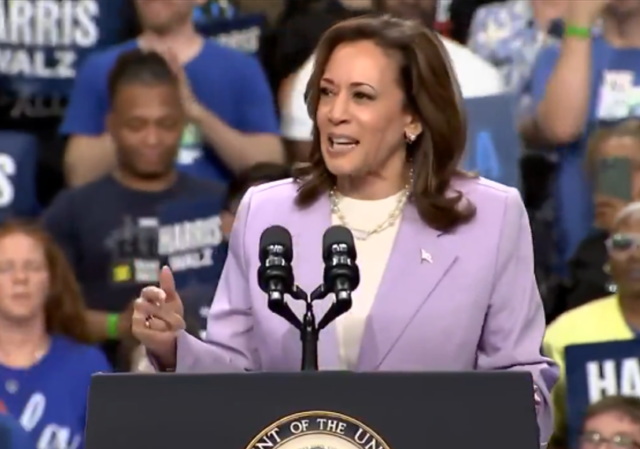

Recently, Vice President Kamala Harris has come under fire for claiming credit for former President Donald Trump’s policy concerning tips and taxes. Harris had previously been vocal about strengthening the IRS’s ability to enforce tip reporting and compliance but is now touting the benefits of Trump’s „no tax on tips“ agenda.

The Background

In 2018, the IRS announced plans to increase enforcement efforts on tip reporting by hospitality industry workers. This move was aimed at closing the so-called „tax gap“ caused by underreporting of tip income. The Trump administration’s policy sought to crack down on businesses that failed to report their employees‘ tips accurately.

Kamala Harris’s Role

During her time as a Senator, Kamala Harris was a vocal advocate for stronger enforcement of tip reporting laws. She introduced legislation that would impose penalties on businesses found to be skirting tip reporting requirements. Harris was also a vocal critic of the Trump administration’s tax policies, particularly its emphasis on tax cuts for the wealthy.

The Controversy

Now, as Vice President, Harris is facing criticism for claiming credit for Trump’s „no tax on tips“ agenda. Some argue that Harris is attempting to rewrite history and take credit for a policy she previously opposed. Others see her comments as an attempt to appeal to a broader base of voters, including those in the hospitality industry.

Conclusion

It remains to be seen how the controversy surrounding Kamala Harris’s claims about Trump’s „no tax on tips“ agenda will play out. However, it serves as a reminder of the complexities of tax policy and the role of politicians in shaping it. As the debate continues, it is important for policymakers to consider the impact of their decisions on workers, businesses, and the economy as a whole.

FAQs

1. What is the „no tax on tips“ agenda?

The „no tax on tips“ agenda refers to a policy that aims to exempt tips received by hospitality industry workers from taxation. Proponents argue that this can help incentivize tip reporting and compliance.

2. Why is Kamala Harris facing criticism for claiming credit for Trump’s policy?

Kamala Harris’s previous stance on tax policies, including tip reporting, has been at odds with that of the Trump administration. Her recent endorsement of Trump’s „no tax on tips“ agenda has raised questions about her consistency and motivations.

3. What are the implications of tip reporting enforcement on businesses and workers?

Stronger enforcement of tip reporting requirements can help ensure that workers receive their fair share of tips and that businesses pay their fair share of taxes. However, it can also increase administrative burdens for businesses and create tensions between employers and employees.