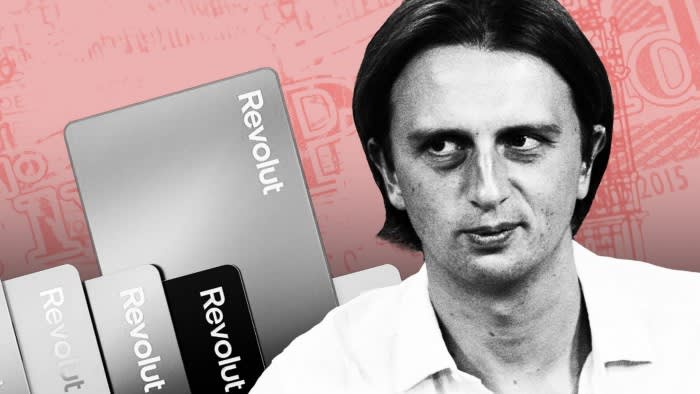

Revolut secures UK banking licence after 3-year wait

Revolut, the fast-growing fintech firm, has finally secured a UK banking licence after a three-year wait. This development is significant for the company, as it will allow them to offer more traditional banking services to their customers.

What does this mean for Revolut?

With the new banking licence, Revolut will be able to offer a wider range of services to its customers. This includes traditional banking products like current accounts, overdrafts, and loans. The company will also be able to provide better protection for customer deposits, as they will be covered by the Financial Services Compensation Scheme.

Why did it take so long?

Securing a banking licence is a complex and lengthy process. Regulatory authorities require fintech firms to meet strict criteria before they can be granted a licence. Revolut had to prove that they had the necessary financial resources, governance structures, and risk management processes in place to operate as a bank.

What are the benefits for customers?

For customers, the new banking licence means greater peace of mind and more options when it comes to managing their finances. They will now have access to a full range of banking services through Revolut, making it easier for them to consolidate their financial activities in one place.

Conclusion

Overall, Revolut securing a UK banking licence is a significant milestone for the company. It will allow them to expand their range of services and provide better protection for customer deposits. This move positions Revolut as a more formidable player in the fintech industry, and cements their reputation as a leading innovator in the sector.

FAQs

How will Revolut’s new banking licence benefit customers?

Customers will have access to a wider range of traditional banking services, such as current accounts, overdrafts, and loans. Their deposits will also be covered by the Financial Services Compensation Scheme.

Why did it take Revolut three years to secure a banking licence?

Obtaining a banking licence is a complex process that requires fintech firms to meet strict regulatory criteria. Revolut had to demonstrate that they had the necessary resources and governance structures in place to operate as a bank.

What does Revolut’s new banking licence mean for the fintech industry?

Revolut’s new banking licence positions them as a more formidable player in the industry and solidifies their reputation as a leading innovator. It also underscores the importance of regulatory compliance and risk management in the fintech sector.